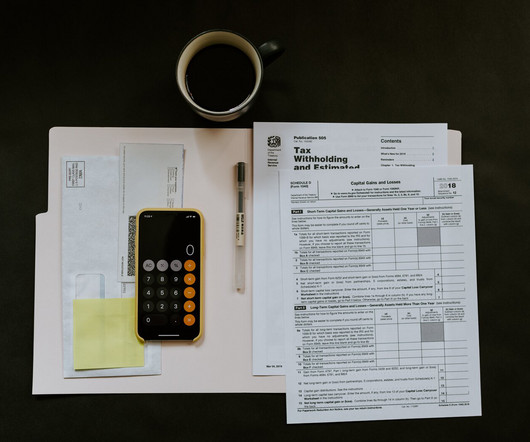

IRS meal and entertainment deductions: Guidelines for DCs

Chiropractic Economics

DECEMBER 17, 2024

Here are some examples that apply specifically to chiropractic practices: 1. These meal and entertainment deductions could be strategic for your chiropractic or integrated practice: 1. This is especially important if your chiropractic or integrated practice faces an audit. MARK SANNA is the CEO of Breakthrough Coaching.

Let's personalize your content